Forms that must be ordered from the IRS are labeled "for information only" and can be ordered online. This policy includes forms printed from IRS.gov and output on high-quality devices such as laser or ink-jet printers, unless otherwise specified on the form itself. We accept forms that are consistent with the official printed versions and do not have an adverse impact on our processing. Enter the number of copies in the Copies text box. Ensure the correct printer is selected in the Print dialog box. Click the attachment to open it in Acrobat or Adobe Reader, and make your. (If the Print button is not in your toolbar, select File > Print. You can use Adobe Acrobat 6 or Adobe Reader 7, or later, to review this document. Currently, there is no computation, validation or verification of the information you enter and you are still responsible for entering all required information. Open the PDF in Adobe Acrobat or Acrobat Reader. IRS fill-in PDF forms use some of the features provided with Adobe Acrobat software, such as the ability to save the data you input (document rights). If you have problems with a file, such as PDF pages that don't appear in the browser window, please review the troubleshooting information in Adobe's support knowledgebase.

When saving or printing a file, be sure to use the functionality of Adobe Reader rather than your web browser.Īll of our PDF files are tested prior to posting on IRS.gov.

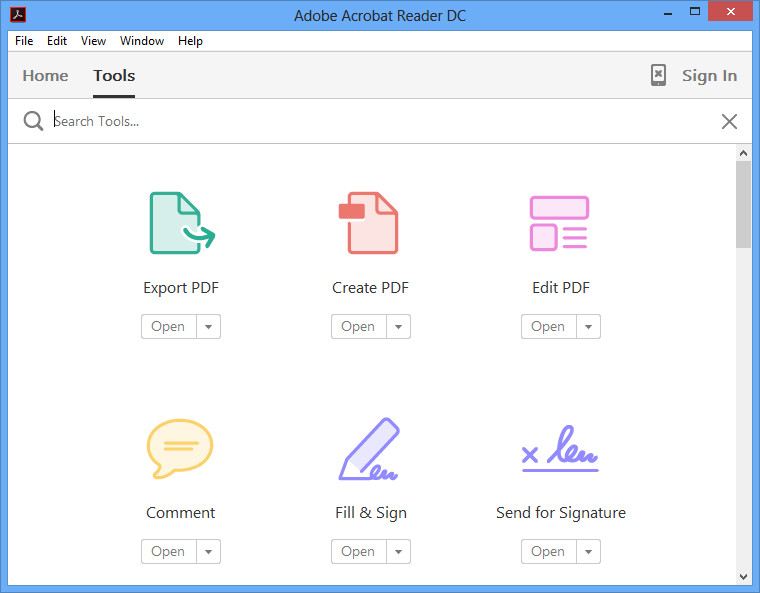

We recommend using the most recent version of Adobe Reader - available free from Adobe's website. You will need to have the Adobe Reader software installed to access them. We use Adobe Acrobat PDF files to provide electronic access to our forms and publications.

0 kommentar(er)

0 kommentar(er)